Over the past three years, battery recycling has received heightened attention, raising critical questions: What is the true state of recycling today? Can it provide the U.S. and EU with secure access to critical minerals, or is recycling a waste of resources given their lack of refining capacity?

The reality is that recycling alone will not provide sufficient productive volume to meet overall demand. Nevertheless, recycling has the potential to play an important role in creating a more circular and sustainable economic model, especially as technologies refine their market fit.

The Economic Realities Of Recycling Shape The Broader Landscape Of Metal Recycling?

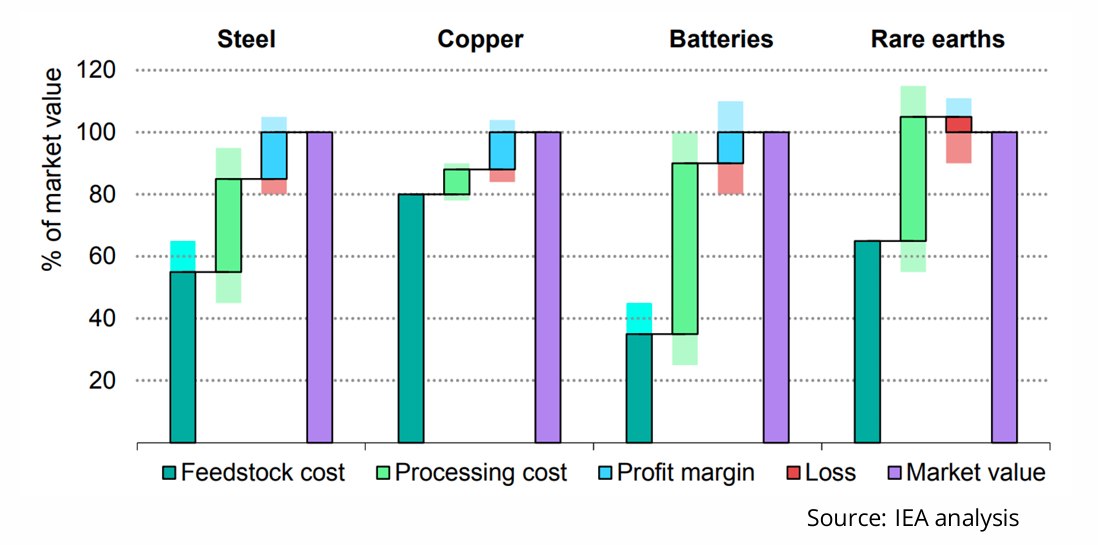

Recycling economics vary across steel, copper, batteries, and rare earths. Steel and copper benefit from mature infrastructure and stable pricing, while batteries and rare earths face high costs and fragmented technology stacks. Battery recycling profits are also volatile due to shifting lithium and cobalt prices, global refining bottlenecks, and transport issues. While this mainly applies to NMC (nickel manganese cobalt), LFP (lithium iron phosphate) chemistries, variants also show notable, though different, volatility.

Economic Analysis of Material Recycling

With China dominating refining, rare earth recycling faces tight supply chains. Unlike batteries, it’s not yet profitable and is mainly driven by strategic value.

Although the EU recently began shifting funding toward rare earth projects, battery recycling start-ups have still struggled to gain lasting traction, as reflected in Glencore acquiring Li-Cycle and Lyten buying out Northvolt. The key question now: which companies will stand out, and will it be through technology innovation, cost control, or strategic supply chain positioning?

Regional Competitive Models

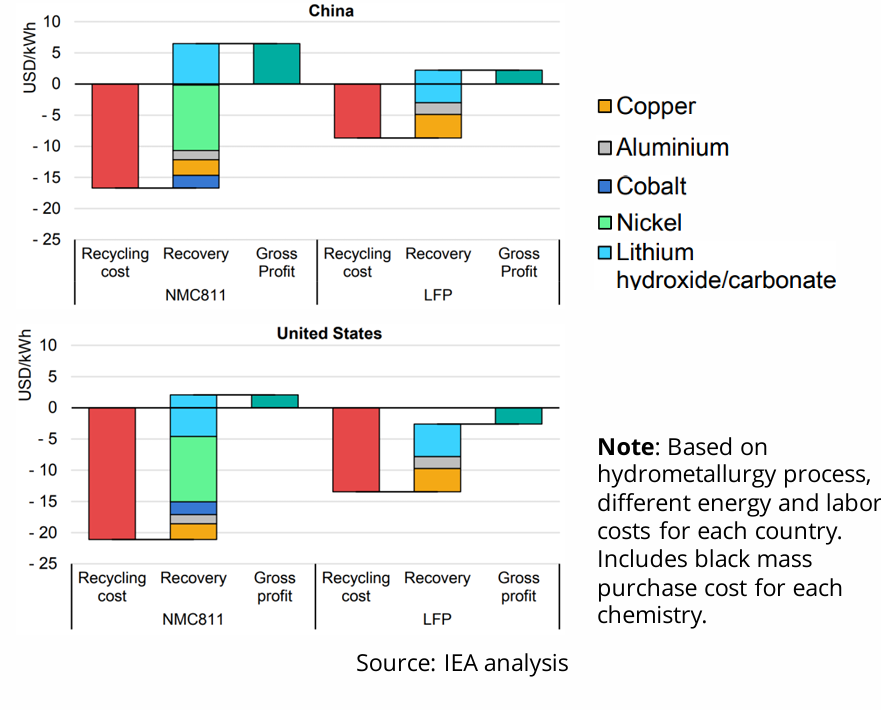

Economic realities of battery recycling vary significantly by region, driven by China’s control of over 80% of key material refining. This dominance has profound implications for the sector’s economics and competitive landscape.

Battery Recycling Economics in the U.S. and China

Recycling NMC batteries in the U.S. is barely profitable, while LFP and other types aren’t economical. In China, both NMC and LFP can be recycled profitably thanks to industrial scale, vertical integration, and lower operating costs.

Three factors set China apart from North America and Europe:

- Battery Chemistry – China can recycle multiple battery types, NMC, LFP, and others, together at scale, owing to its strong base in cell and cathode manufacturing

_ - Materials Pricing – Nickel and cobalt make NMC appealing to U.S. recyclers, while China’s diverse materials mix helps keep recycling profitable across chemistries

_ - Location and Labor – China’s skilled labor costs are often half those in the U.S., and its recycling plants are five times larger—boosting efficiency and scale

Alternative Regional Models

- Australia – Building a vertically-integrated lithium supply chain, including recycling capabilities

_ - South Korea – Linking advanced recycling to its strong manufacturing base

_ - India and Thailand – Targeting low-speed EV markets through collaborations such as Tata with Lohum, markets largely overlooked by China

Innovation in processing and disassembly will be critical:

- Collection & Sortation: Robotics and automation can improve efficiency if chemistries are standardized and easily identifiable

_ - Disassembly: Automation reduces safety risks like fires and fluoride exposure

_ - Preprocessing: A bottleneck in the U.S. and EU, where companies such as Cyclic Materials (automation) and Blue Whale Materials (transport cost reduction) are emerging as key players

LIB Recycling Innovator Landscape

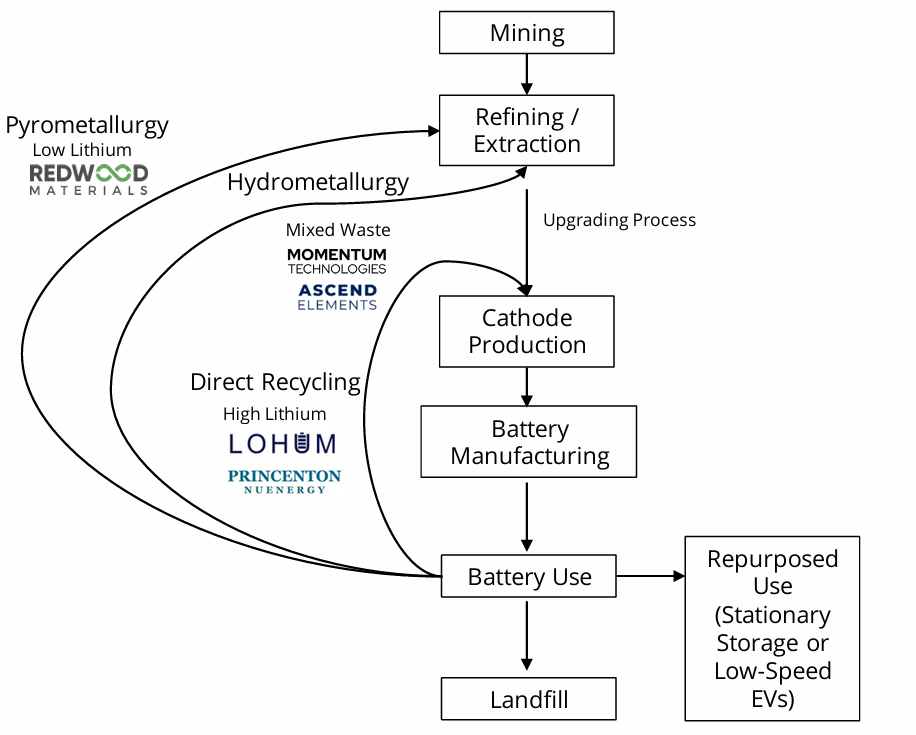

Technologically, hydrometallurgy and direct cathode recycling show the most promise, while pyrometallurgy is fading due to inefficiency and lithium losses.

Limitations of Pyrometallurgy

Pyrometallurgyfaces fundamental limitations that constrain its long-term viability. Chief among these is its inability to preserve lithium. The process effectively destroys most lithium content, making it unsustainable as demand for lithium intensifies. Lower-temperature variants can be combined with subsequent hydrometallurgical processing, but these hybrid approaches incur significant energy losses and efficiency trade-offs. From both an economic and technological perspective, this pathway is unlikely to remain competitive.

Hydrometallurgy and Emerging Innovators

Hydrometallurgy has emerged as the leading recycling technology in most advanced markets. As a water-based process, it excels at handling mixed waste streams and is adaptable to diverse chemistries. New entrants are innovating within this framework:

- Momentum Technologies is developing modular hydrometallurgical units deployed directly at preprocessing sites, aiming to reduce transportation costs and bypass intermediary recyclers

- Ascend Elements: After initial success in North America, is now expanding into Europe. Its ability to scale while adapting to Europe’s more complex regulatory and market environment will be a key test

Direct Recycling: A Strategic Shift

Direct cathode recycling is the sector’s most disruptive innovation—it keeps the cathode’s crystalline structure intact and needs less reprocessing than hydrometallurgy and pyrometallurgy, making it ideal for regions without large-scale refining but increasing mineral demand. As the market shifts toward LFP batteries, direct recycling becomes even more relevant. Companies like Princeton NuEnergy and Lohum are scaling up with new technologies, offering a way for places like Europe, South Korea, Japan, and the U.S. to bypass refining bottlenecks and feed recovered materials straight back into production.

Policy and Market Scenarios: Looking Ahead

Global competitiveness in battery recycling will be shaped not only by technology, but also by policy:

- Business-as-Usual: China continues to consolidate its dominance in refining and recycling, with declining LFP prices reinforcing its position as the sole economically viable market

_ - Niche Market: China retains control of the mainstream industry, while other regions maintain limited, region-specific recycling operations constrained by restrictive or short-sighted policies

_ - Market-Winning: Robust policy support enables the development of integrated supply chains centered on direct recycling, allowing the U.S., EU, Korea, and Japan to establish competitive industries despite higher operational costs.

Policy Will Be the Decisive Factor

The EU’s initiatives show ambition but risk without secure feedstock, while China’s easing of black mass restrictions indicates an emerging attempt to consolidate battery recycling feedstock. To achieve a competitive position, governments must pair support for direct recycling with improved preprocessing, feedstock access, and integration into domestic manufacturing capabilities.